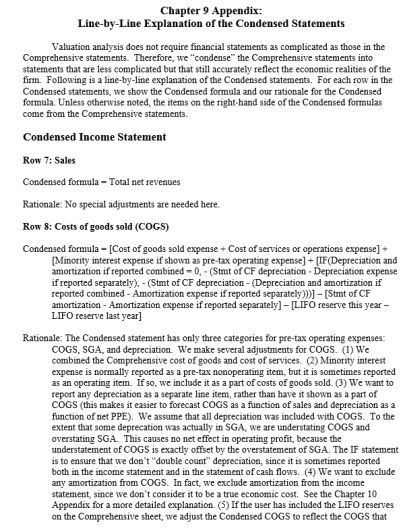

Amortization expense formula

Following are the importance of. With the above information use the amortization expense formula to find the journal entry amount.

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

The value for the double-entry will depend on the amortization calculation based on the above.

. The expense would go on the income statement and the accumulated amortization will show up on the. NPER Rate PMT PV 3. 612 0005 per month.

Unlike the first formula which uses operating income the second formula starts with net. The general syntax of the formula is. The first step is to convert the yearly interest rate into a monthly rate.

The NPER function aids us to know the number of periods taken to repay. The next thing to do is to multiply your principal amount with the monthly interest rate. The Depreciation formula uses the Deprecation formula to spread the assets cost over its useful life thereby reducing the huge expense burden in a single year.

The accounting for amortization expense is a debit to the amortization expense account and a credit to the accumulated amortization account. For intangible assets with an indefinite. Hi I am trying to create a dynamic prepaid expense amortization template with a formula that can be used for any new.

What is the Loan Amortization Formula. Here is the step by step approach for calculating Depreciation expense in the first method. Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of.

This is the cost of the fixed asset. I have the following columns in my spreadsheet and would like to insert a formula that will automatically update all of the applicable months with the correct amount. It is more difficult to determine the useful life of an intangible asset than a tangible asset.

EBITDA Net Income Taxes Interest Expense Depreciation Amortization. Companies use an amortization schedule to separate interest expenses and principal amounts from a monthly payment. For intangible assets the amortization journal entries are similar to depreciation.

Debit Amortization Expense - 10000 Credit Accumulated Amortization - 10000. Initial value residual value lifespan amortization expense. Determining the Life of Intangible Assets.

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Ebit Vs Ebitda Differences Example And More Bookkeeping Business Accounting Education Financial Analysis

The Freedom Formula How To Turn 244 000 Into 1 4m In 14 Years Investing Architect Investing Debt Service The Freedom

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Pin On Investing Investment Clubs Taxes

How To Amortize Intangible Assets Http Www Svtuition Org 2014 06 How To Amortize Intangible Assets Ht Accounting Education Learn Accounting Intangible Asset

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Myeducator Accounting Education Accounting Accounting Classes

Cash Flow From Operating Activities Learn Accounting Financial Analysis Accounting Education

Times Interest Earned Formula Advantages Limitations Accounting And Finance Financial Analysis Accounting Basics

Accounting Equation Chart Cheat Sheet In 2022 Accounting Accounting Education Payroll Accounting

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries